Warm Greetings & Welcome to a New Experience

Please let Me take the "Noise" Out of Your Ears. Given My 25+ Years Dedicated to the World of Asset Based and Senior Secured Lending, I am Actively Working with Borrowers, Lenders (Traditional & Alternative), Advisors, Due Diligence Service Providers, & Others in Order to Enjoy an Efficient Transactional Experience.

HOW WE MAKE A POSITIVE & ACTIONABLE IMPACT

KNOWLEDGE & MARKET INTELLIGENCE: 25+ Years of Asset Based & Senior Debt Capital Solutions Experience. I Understand How Lenders Think and Behave - in the Good Times and the Bad. Having been "Boots on the Ground" in *Most Roles within Public and Private ABL Platforms plus an Additional 4+ Years of Large Commercial Realty and M&E Financing - I Fully Comprehend the "Levers and Pulleys" in Legal and Business Documentation, as well as, Structuring and Negotiating Palatable Solutions to Avoid such "Pitfalls".

EXPERTISE, CREATIVITY & INFLUENCE: I Possess a Thorough Understanding of All Loan Documentation and if Desired, Pro-Actively Manage the Organization, Planning, and Execution of the Contemplated Opportunity(ies), Transaction(s), Amendments etc. and, as such, Shall be Able to, Well in Advance, Identitfy Issues, Mitigants and Creatively Manage through "Gaps" and Incoming Obstacles. I Pro-Actively Manage the Processes and Ensure Expeditious Critical and Transparent Communication with my Client and Partners. Courage to Communicate Effectively Reigns.

EXPERTISE, CREATIVITY & INFLUENCE: I Possess a Thorough Understanding of All Loan Documentation and if Desired, Pro-Actively Manage the Organization, Planning, and Execution of the Contemplated Opportunity(ies), Transaction(s), Amendments etc. and, as such, Shall be Able to, Well in Advance, Identitfy Issues, Mitigants and Creatively Manage through "Gaps" and Incoming Obstacles. I Pro-Actively Manage the Processes and Ensure Expeditious Critical and Transparent Communication with my Client and Partners. Courage to Communicate Effectively Reigns.

Over the trailing 25+ years, I have worked with Top Tier North American Public and Private Institutions within their respective Asset Based Lending, Commercial Realty & M&E Financing Units:

i) Senior Loan Portfolio & Credit Relationship Management (12 years +) Intelligently managing internal and external relationships & collateral analyst / operational management (Proficiency with STUCKY--> Solifi / ABL Soft), as well as, actionable knowledge with respect to transactional due diligence matters (and third party service providers), ratings, KYC & AML functions, FINTRAC screening, FCPA, continual / daily education, as expected;

US$5B+ Single, Agented and Syndicated Loans.

ii) Senior Underwriting & Syndications (10 years +)

Proactively liaise with all stakeholders, propose structures, issues / mitigants, pitfalls --> effectively underwrite to the "Term Sheet" / Proposal Letter", in a timely manner, in order to manage expectations, fully equipped (with Reputable Partners) to manage all processes including committee presentations, lead communication, coaching, due diligence, processes, negotiation of legal documentation with certainty of execution - whilst seamlessly working within a Team or Independently. US$5B+ underwritten (including Agenting / Managing Syndications).

iii) Originations (8 years +)

I am a hunter and gatherer, seeking to bring new relationships to the table (IE: New Relationships and Not Recycled / Amend and Extend etc.) and I create opportunities with entrepreneurs and champions of public companies.

I fully support "Client Retention" through the "sometimes challenging" intra-institution passage of Clients from one P&L to another (IE: Chartered Bank Cashflow Facility to ABL Facility or to the Special Assets Management Unit ("SAMU").

Retaining business, if it can "fit" into another business unit of a financial institution is ideal (from a cost perspective / flow of relationship / documentation) --> "Plug the Leaks in the Boat"), HOWEVER, I prefer to Originate - Hand-Hold and Guide New Relationships through, What may be a frustrating exercise, by Listening Carefully to Your Needs and Providing Organized, Intelligent and Educational Feedback, which leads to an Enhanced Experience and Generates what I refer to as "Stickiness". In the case of borrower or lender "fatigue", I will gladly assist you with respect to securing the "proper" fit.

I am always happy to take the lead, and I openly work with trusted Partners in the community and I flex to the situation.

EXPERTISE, CREATIVITY & INFLUENCE: I Possess a Thorough Understanding of All Loan Documentation and if Desired, Pro-Actively Manage the Organization, Planning, and Execution of the Contemplated Opportunity(ies), Transaction(s), Amendments etc. and, as such, Shall be Able to, Well in Advance, Identitfy Issues, Mitigants and Creatively Manage through "Gaps" and Incoming Obstacles. I Pro-Actively Manage the Processes and Ensure Expeditious Critical and Transparent Communication with my Client and Partners. Courage to Communicate Effectively Reigns.

EXPERTISE, CREATIVITY & INFLUENCE: I Possess a Thorough Understanding of All Loan Documentation and if Desired, Pro-Actively Manage the Organization, Planning, and Execution of the Contemplated Opportunity(ies), Transaction(s), Amendments etc. and, as such, Shall be Able to, Well in Advance, Identitfy Issues, Mitigants and Creatively Manage through "Gaps" and Incoming Obstacles. I Pro-Actively Manage the Processes and Ensure Expeditious Critical and Transparent Communication with my Client and Partners. Courage to Communicate Effectively Reigns.

EXPERTISE, CREATIVITY & INFLUENCE: I Possess a Thorough Understanding of All Loan Documentation and if Desired, Pro-Actively Manage the Organization, Planning, and Execution of the Contemplated Opportunity(ies), Transaction(s), Amendments etc. and, as such, Shall be Able to, Well in Advance, Identitfy Issues, Mitigants and Creatively Manage through "Gaps" and Incoming Obstacles. I Pro-Actively Manage the Processes and Ensure Expeditious Critical and Transparent Communication with my Client and Partners. Courage to Communicate Effectively Reigns.

Our Expert Knowledge of *"MOST THINGS" Asset Based Lending and a deep knowledge of other Senior Secured Debt Lending Products has been Accrued by Working within *Most Roles of Public and Private ABL Lending Platforms (*save and except CEO, COO, and CFO). A Major Advantage, I Know How Lenders Think and Behave.

i) Day to Day: Consistently perform across all ABL disciplines and seamlessly adapt to various lender's credit criteria whilst actively engaging with team members, existing relationships and creating new relationships. As aforementioned, I thoroughly enjoy nurturing relationships, creating new relationships, sourcing solutions through creative structures (sometimes in conjunction with Partners), Originations by creating new opportunities through intelligent research, networking and maintaining a pulse on evolving changes in the overall economy.

ii) Early Stage "Real World" Education: I had the privilege, commencing at the age of 22 years old, of working with one of the most successful Canadian ABLs (sub of a Large U.S. Bank), on a small "A Team". Given our smaller roster of employees, I was fortunate to have been brought into the boardroom, at an early age, to listen, observe behaviour, "soak up everything", hence providing me with the ability to easily author / underwrite formal amendments and proposals, for some of the most historical businesses in Canada and the U.S.

Years later, I possessed the essential skills to lead the charge in such meetings, whether procuring and presenting new business opportunities, or assisting with existing portfolio businesses (M&A / Restructurings (Informal / Formal; Renewals etc.)

iii) Over 25 Years - Actively Recruited into Two (2) Successful Canadian and One (1) U.S. ABL Start-Up Platforms: Reporting directly to the Chief Executive Officer, in all cases, developing and creating operating credit / lending policies, procedures and templates, (ie: Manuals, Tailored Ratings, AML/KYC, Preliminary Pre-Screen, and Underwriting Templates (CIMs) etc.

VAST NETWORK OF REPUTABLE AND NOTEWORTHY RELATIONSHIPS: Developed over the Trailing 25+ Years of My Lending Career, My experience, working alongside, with 100's of private and public businesses, whether they be small, medium and / or large, North American, Multi-Jurisdictional (foreign etc.) has Provided Me with the Ability to Pick Up the Phone and Achieve Timely and Qualified Responses.

EXPERTISE, CREATIVITY & INFLUENCE: I Possess a Thorough Understanding of All Loan Documentation and if Desired, Pro-Actively Manage the Organization, Planning, and Execution of the Contemplated Opportunity(ies), Transaction(s), Amendments etc. and, as such, Shall be Able to, Well in Advance, Identitfy Issues, Mitigants and Creatively Manage through "Gaps" and Incoming Obstacles. I Pro-Actively Manage the Processes and Ensure Expeditious Critical and Transparent Communication with my Client and Partners. Courage to Communicate Effectively Reigns.

VAST NETWORK OF REPUTABLE AND NOTEWORTHY RELATIONSHIPS: Developed over the Trailing 25+ Years of My Lending Career, My experience, working alongside, with 100's of private and public businesses, whether they be small, medium and / or large, North American, Multi-Jurisdictional (foreign etc.) has Provided Me with the Ability to Pick Up the Phone and Achieve Timely and Qualified Responses.

The REAL LIFE Experience that I have accrued, acting as "Boots on the Ground", championing transactions, particularly on the private side has bestowed upon me a set of skills*, that provide me with the ability to work with a high level of independent efficiency, ALONG with the tremendous support from My Robust Network of Relationships ("Decision-Makers") allowing Everyone to Prudently and Efficiently Navigate from A to B.

*Originate, Structure, Internally Screen, Issue / Negotiate Execution of Term Sheet, Fully Underwrite Transaction whilst Managing and Working Alongside all Internal and External parties, Present to Credit Committee, Approval Obtained, Negotiate Legals (in concert with credit) and Execute.

Our Multi-Jurisdictional Relationships span, North America, Mexico as well as portions of South America, Europe, Asia, Australia and the Caribbean Islands.

We seek to develop mutual trust, loyalty, respect and integrity (the "4-Legged Stool") through fully transparent, honest and prompt timely communication allowing us to work as seamlessly as possible. We lead with a Bias to Action.

Reviewed and Invited to Bid and / or participate on US$15B+ of transactions over trailing three (3) years.

EXAMPLE of SERVICES

Due Diligence, Market Intelligence, and Review of "ANY" Documentation Related to a Transaction or a Contemplated Transaction.

Due Diligence, Market Intelligence, and Review of "ANY" Documentation Related to a Transaction or a Contemplated Transaction.

Due Diligence, Market Intelligence, and Review of "ANY" Documentation Related to a Transaction or a Contemplated Transaction.

Time is of the essence and the deal timeline is ALWAYS proactively, efficiently and transparently managed - No Surprises. HOWEVER, beware of pitfalls or "walking into a default" shortly after financing. We fully assist you in "staying the course ", on time, to ensure that the appropriate due diligence is performed and UNECESSARY, costly, due diligence is not required. Particularly if You are a prospective borrower or a lender that does not possess the expertise that is contemplating a transaction where there will be a competitive process and We wish to ensure that the due diligence scope performed and the parties conducting such due diligence are acceptable to all parties involved.

Let's get it Right the first time with the appropriate parties so that human capital and capital resources are efficiently actioned.

Negotiations are an Inclusive Service to All Stakeholders in an ABL Refinancing or Senior Secured Debt Refinancing

Due Diligence, Market Intelligence, and Review of "ANY" Documentation Related to a Transaction or a Contemplated Transaction.

Due Diligence, Market Intelligence, and Review of "ANY" Documentation Related to a Transaction or a Contemplated Transaction.

Negotiations are positive as they generally lead to positive outcomes (in my personal experience, anyways). We assist all stakeholders involved in ABL and / or senior debt capital transactions. You may be a borrower contemplating a pro-active move to an asset--based lending structure (with one or multiple lenders), in order to precipitate liquidity out, of the intrinsic value of the business assets, for specific purposes (W/C; Dividend Recap, SH Loan Repayment; take advantage of early pay discounts - the list of advantages goes on ( I can easily determine a structure and / or a multitude of structures that would be palatable to the lenders that I would present to You and work through the entire process with Yourself and Team (if you wish) to ensure expertise, provide "tricks of the trade" by lenders, fluid professional discussion and timely responses.

Conversely, You could be a borrower or group of borrowers being forced into special loans due to various reasons. Depdendent upon the state of your business, Let's discuss and explore, potential solutions that will provide You, the borrower, with a softer landing into an ABL or alternative financier that will work with you to informally restructure or formally restructure the business - leading to the preservation and continuance of business operations.

If formally restructuring, I would be presenting Reputable Expert Partners, qualified in formal restructurings to the borrower - and will work with the Partner, if required.

Negotiation services are available to all stakeholders in a transaction. The above is a broad example from a borrower perspective. If You are a lender, alt. lender, due diligence service provider (ie: Field Exam Team, Appraiser, legal professional etc.) with some basic questions - please reach out for a professional and confidential call.

Transparent and Careful Guidance

Transparent and Careful Guidance

Transparent and Careful Guidance

You Are Not Alone.

We shall listen carefully and ascertain Your needs and propose palatable debt capital solutions in an organized manner;

In the Event that We cannot directly assist, and We will know expeditiously, We shall set forth a plan to "warmly" introduce you to an appropriate roster of "Partner" professionals.

If You are already formally engaged, We are more than happy to engage on a sub-contractual basis, if it provides value to the process (ie: time / cost savings / referrals etc.)

Robust Network & Referrals

Transparent and Careful Guidance

Transparent and Careful Guidance

We Love Referring.

It's a Win Win. While We may possess expertise in "All Things ABL", We Stay in Our Lane.

We do NOT waste Your valuable resources by taking on engagements or portions thereof - where We do not possess the knowledge. We efficiently bring into the process "real" options with "Decision Makers". We love our "Partners" and they love us.

By way of leveraging our robust roster of Trusted "Decision Makers", whom We have developed relationships with, over years and decades, working alongside and / or precipitating out synergies together - these "Partners" are ready and willing to assist in a confidential team effort to ensure a fluid process and execution.

While opportunities are, always, presenting themselves, which is superb - We are passionate regarding the creation and evolution of opportunities. Through our Network of Trusted Professionals, Accrued Knowledge, Funnel of Information & Market Intelligence, We connect, in a "finessed / warm" manner, with all types of businesses that "tangent" Asset Based Lending and Senior Secured Debt.

Our Robust North American Network of Financial Professionals Across All Industries Include, but are NOT limited to the following: Public and Private Lenders, Family Offices, Potential Borrowers or "Targets", M&A / Restructuring, Due Diligence (THE APPROPRIATE Collateral Field Examiners and Appraisers (IE: Require a fully acceptable and tailored IP appraisal for various valuations from a Trusted Appraiser? Please let Me Introduce You to the Appropriate Parties.

About Me: Professional Background - Know Your Advisor "KYA"

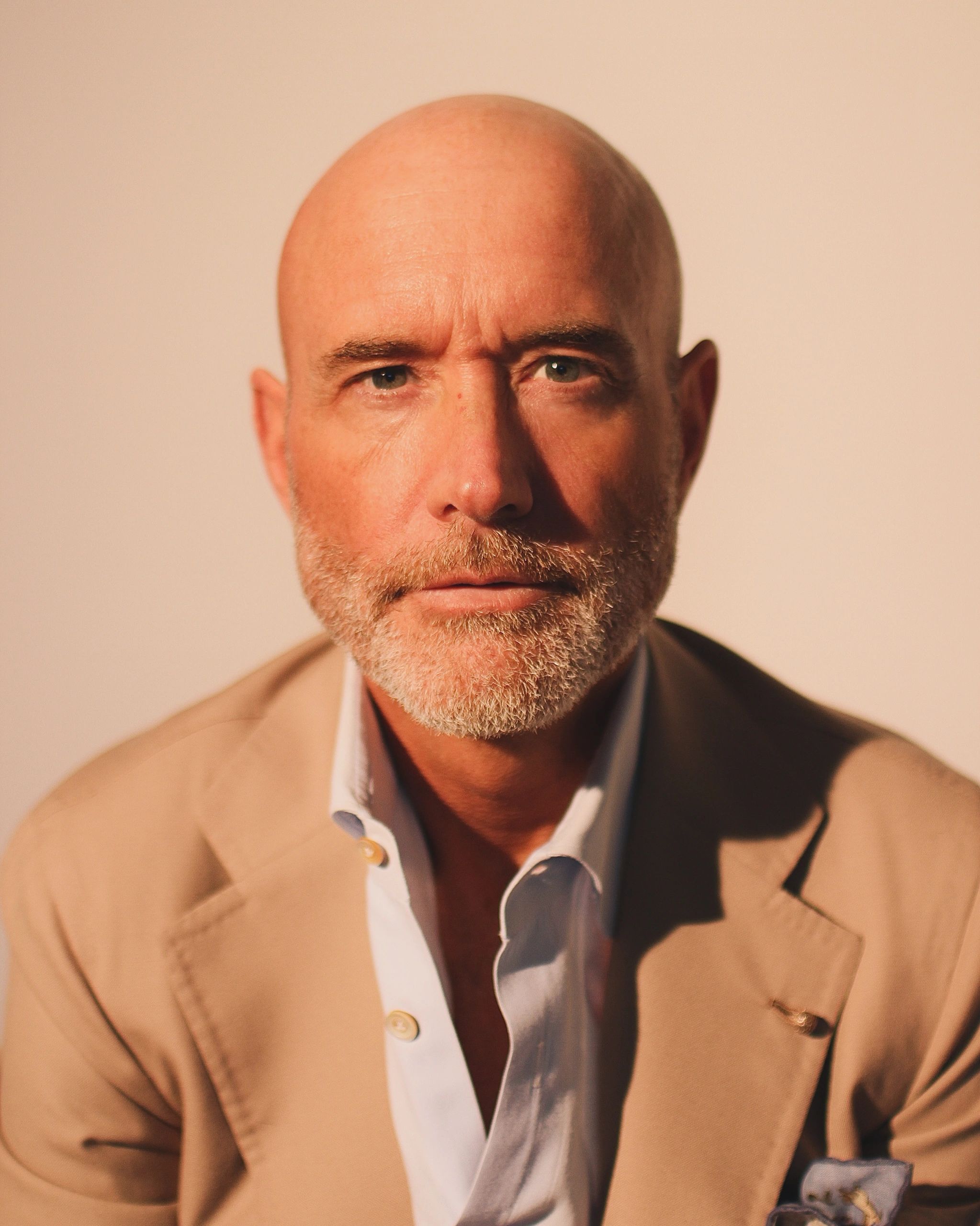

Founder & Principal: Geoffrey J. Hiscock - 25+ Years of Asset Based & Senior Secured Lending - Industry Agnostic

While attending Queen's University Canada ("Queen's") in 1992, I was not convinced of the various paths that I could have followed. I was fortunate to have a multitude of opportunities and choices that were in front of me.

I completed two (2) degrees in four (4) years: i) BSc in Life Sciences (minor in Psych) with the option of attending Medical School, and a; ii) BA in Economics, and completed the Canadian Securities Course ("CSC") in my 3rd Year at Queen's, followed by the Conduct Practices Handbook ethics course ("CPH"), following graduation in 1996.

Given my "peaked" interest in the financial services sector, I pursued a career in financial services, and, by chance, I became involved in the factoring industry in 1996, and shortly thereafter (10 months), I was introduced to the concept of Asset Based Lending. In 1997, I joined a growing Canadian ABL platform that was a wholly-owned subsidiary of a large U.S. regional bank.

I grew up, quickly, in credit, chiefly working alongside the Senior Vice President, Chief Credit Officer ("CCO"), acting as their shadow, attending meetings with some of Canada's largest historical companies ("Borrowers"), legal counsel, due diligence providers and learning how to properly engage and communicate, analyze, propose, author and execute structured solutions with Stable, Growing and Distressed Borrowers. Some broad examples include: i) M&A Senior Debt financing of Borrowers' "Target Assets" including all working capital, PP&E, IP / Brands, cashflow solutions etc.; ii) Amend and Extend / Renewals; iii) Exits (Successful or Liquidations) iv) Syndications; and v) Identifying and validating any legal and operational issues typically liquidity issues or My detection of fraudulent borrower behaviours. Transaction HOLD: $2MM - $75MM

Following 7 years of intense credit and underwriting education, by 2004, I was actively moving forward in my ABL career and joined a number of much larger Canadian and U.S. Bank ABL Platforms over the years, as well as a Canadian Federal Government Bank originating and managing Senior Secured Commercial Realty and Equipment / Other fixed asset term loans. Transaction HOLD: $10MM - $175MM

As, aforementioned, I was involved in the start-up of two (2) private ABL Platforms - reporting directly to the Chief Executive Officer, in each instance. Typically, Industry Agnostic: aquaculture, agriculture (horticulture), automotive, construction & takeout (Commerical Real Estate Only), defence (lethal and non-lethal), distribution, forestry (land / waterways / processing / mills / end products such as paper), logistics, manufacturing and services (Consumer Packaged Goods, Food & Beverage, Heavy Manufacturing etc.), commodities such as metals, O&G, renewables, as well as providing leveraged financing to private finance companies.

Transaction HOLD: $10MM - $75MM

Now, having worked for 25+ years, managing, sourcing, structuring and placing capital with 100's of North American (and some foreign) borrowers and working in conjunction with other lenders (small - large), a multitude of family offices, private equity groups (small - large), advisors and due diligence service providers has propelled myself into a world with many open doors to explore - outside of being a capital provider.

As such. recognizing my abilities and extensive professional network, I made the decision to pivot and seek to be a "Jack of All Trades" / "Hired Gun" in the World of Asset Based Lending and Senior Secured Capital Markets. This step provides me with the flexibility to provide a multitude of solutions for my growing network of Borrowers (or prospective Borrowers), Lenders (Public and Private), Advisors, Brokers etc.

Conflicts of Interest Shall be Immediately Addressed Prior to any Engagement.

Please Contact Us

Your Time, Preservation of Reputation, Confidentiality and Driving Net Positive Results is Paramount

Time is a Value that Cannot be Recovered. We value your time and shall not waste it. Our mission is to eliminate unnecessary "noise" in your daily operations, by way of working alongside with yourself and stakeholders, in order to deal with existing issues and pro-actively navigate and provide prudent and transparent guidance in a timely manner.

*IMPORTANT NOTE THAT WE SEEK TO ASSIST BUSINESSES WITH AT LEAST 12 MONTHS OF DEMONSTRATED PERFORMANCE - PREFERRABLY WITH TTM REVENUE OF AT LEAST $1MM.

Hiscock Asset Based Capital Solutions Inc.

70 Distillery Lane, Toronto, Ontario M5A 0E3, Canada

Email: geoffreyhiscock@assetbasedsolutions.ca Websites: www.assetbasedsolutions.ca www.habcs.ca LinkedIn: <<https://www.linkedin.com/in/geoffreyhiscock/<<

Email Requests will be Responded to within one (1) business day.

Subscribe

Valuable ABL Market Insights & Intelligence, Case Studies, Education, Pro-Active Advice & More!

Copyright © 2024 Hiscock Asset Based Capital Solutions Inc. - All Rights Reserved.

Powered by GoDaddy

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.